Investing for Beginners: A Quick and Easy Guide to Investment

Ramit’s

investing

approach:

Follow

the

Ladder

of

Personal

Finance

There

are

six

steps

you

should

take

to

invest.

Each

rung

of

the

ladder

builds

on

the

previous

one,

so

when

you

finish

the

first,

go

on

to

the

second.

If

you

can’t

get

to

the

sixth

step,

don’t

worry—do

your

best

for

now.

Here’s

how

it

works:

Rung

#1:

Contribute

to

your

401k

Each

month

you

should

be

contributing

as

much

as

you

need

to

in

order

to

get

the

most

out

of

your

company’s

401k

match.

That

means

if

your

company

offers

a

5%

match,

you

should

be

contributing

AT

LEAST

5%

of

your

monthly

income

to

your

401k

each

month.

A

401k

is

one

of

the

most

powerful

investment

vehicles

at

your

disposal.

Here’s

how

it

works:

Each

time

you

get

your

paycheck,

a

percentage

of

your

pay

is

taken

out

and

put

into

your

401k

pre-tax.

This

means

you’ll

only

pay

taxes

on

it

after

you

withdraw

your

contributions

when

you

retire.

Often,

your

employer

will

match

your

contributions

up

to

a

certain

percentage.

For

example,

imagine

you

make

$150,000

per

year

and

your

company

offers

3%

matching

with

their

401k

plan.

If

you

invested

3%

of

your

salary

(around

$5,000)

into

your

401k,

your

company

would

match

your

amount,

effectively

doubling

your

investment.

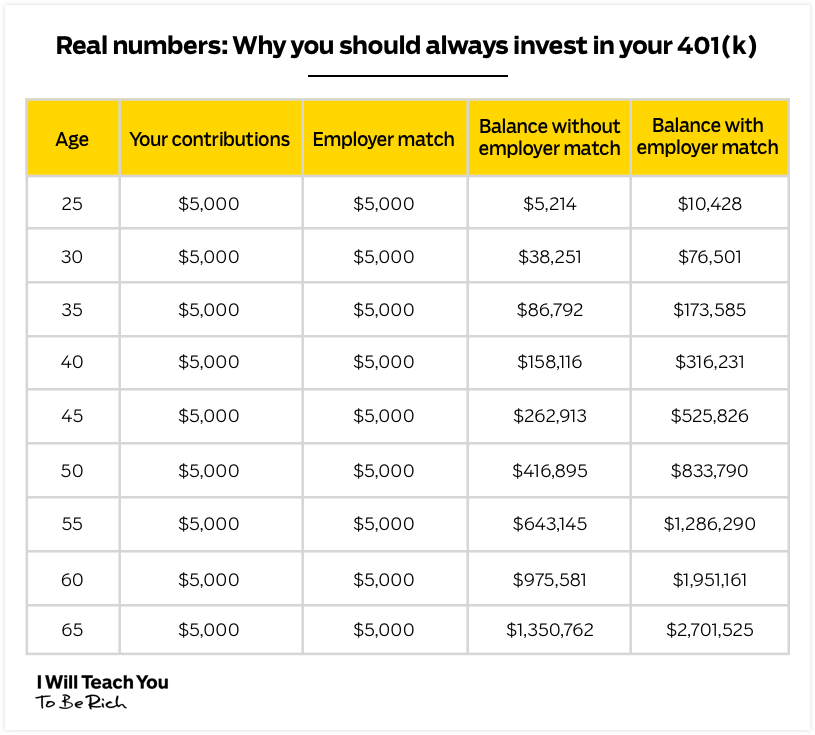

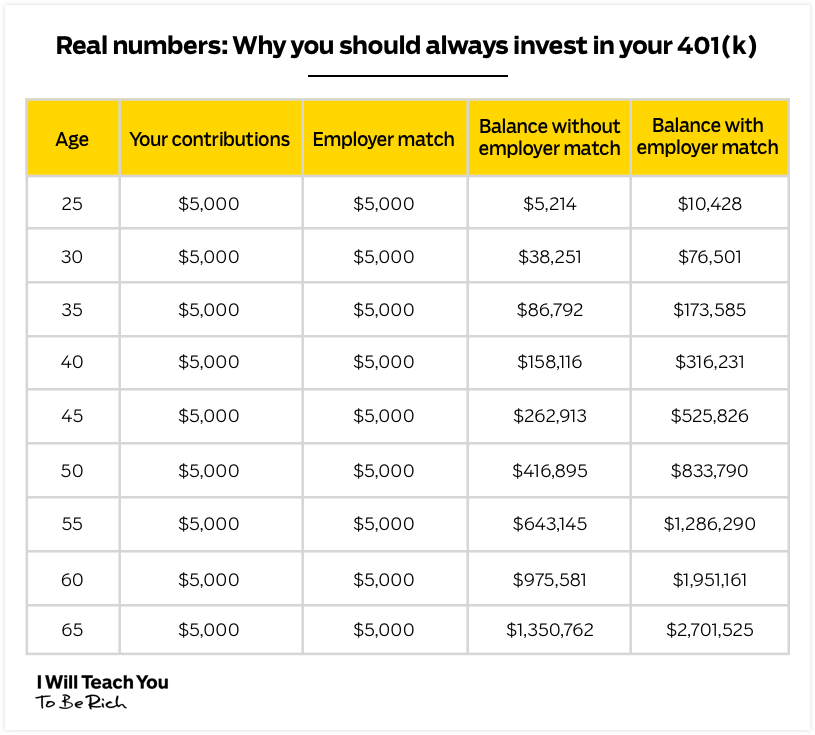

Here’s

a

graph

showcasing

this:

This,

my

friends,

is

free

money

(aka

the

best

kind

of

money).

Not

all

companies

offer

a

matching

plan

—

but

it’s

rare

to

find

one

that

doesn’t.

If

your

company

offers

a

match,

you

should

at

least

invest

enough

to

take

full

advantage

of

it.

Where’s

my

401k

money

going?

You

have

the

option

to

choose

your

investments

when

you

put

money

into

a

401k.

However,

most

companies

also

give

you

the

option

to

entrust

your

money

with

a

professional

investing

company.

They’ll

give

you

a

variety

of

investment

options

to

choose

from

and

can

help

answer

any

questions

you

have

about

your

401k.

The

other

great

thing

about

a

401k

is

how

easy

it

is

to

set

up.

You

just

have

to

opt

in

when

your

company’s

HR

department

offers

it.

They’ll

withdraw

only

as

much

as

you

want

them

to

invest

from

your

paycheck.

When

can

I

withdraw

money

from

my

401k?

You

can

take

money

out

of

your

401k

when

you

turn

59

½

years

old.

This

is

the

beginning

of

the

federally

recognized

retirement

age.

Of

course

you

CAN

take

money

out

earlier

—

but

Uncle

Sam

is

going

to

hit

you

with

a

10%

federal

penalty

on

your

funds

along

with

the

taxes

you

have

to

pay

on

the

amount

you

withdraw.

That’s

why

it’s

so

important

to

keep

your

money

in

your

401k

until

you

retire.

If

you

should

ever

decide

to

leave

your

company,

your

money

goes

with

you!

You

just

need

to

remember

to

roll

it

over

into

your

new

company’s

plan.

Rung

#2:

Pay

off

high-interest

debt

Once

you’ve

committed

yourself

to

contributing

at

least

the

employer

match

for

your

401k,

you

need

to

make

sure

you

don’t

have

any

debt.

If

you

don’t,

great!

If

you

do,

that’s

okay.

I

have

4

ways

to

help

you

get

out

of

debt

quickly.

Rung

#3:

Open

a

Roth

IRA

Once

you’ve

started

contributing

to

your

401k

and

eliminated

your

debt,

you

can

start

investing

into

a

Roth

IRA.

Unlike

your

401k,

this

investment

account

allows

you

to

invest

after-tax

money

and

you

collect

no

taxes

on

the

earnings.

There’s

a

maximum

for

how

much

you

can

contribute

to

your

Roth

IRA,

so

stay

up

to

date

on

the

yearly

maximum.

Unlike

a

401k,

a

Roth

IRA

leverages

after-tax

money

to

give

you

an

even

better

deal.

This

means

you

put

already-taxed

income

into

investments

such

as

stocks

or

bonds

and

pay

no

money

when

you

withdraw

it.

When

saving

for

retirement,

your

greatest

advantage

is

time.

You

have

time

to

weather

the

bumps

in

the

market.

And

over

the

years,

those

tax-free

gains

will

prove

an

amazing

deal.

Your

employer

won’t

offer

you

a

Roth

IRA.

To

get

one,

you’ll

have

to

go

through

a

broker.

There

are

a

lot

of

elements

that

can

determine

your

decision,

including

minimum

investment

fees

and

stock

options.

A

few

brokers

we

suggest

are

Charles

Schwab,

Vanguard

(this

is

the

one

I

use),

and

E*TRADE.

NOTE:

Most

brokers

require

a

minimum

amount

for

opening

a

Roth

IRA.

However,

they

might

waive

the

minimum

if

you

set

up

a

regular

automatic

investment

plan.

Where

does

the

money

in

my

Roth

IRA

get

invested?

Once

your

account

is

set

up,

you’ll

have

to

actually

invest

the

money.

Let

me

say

that

again,

once

you

set

up

the

account

and

put

money

into

it,

you

still

need

to

invest

your

money.

If

you

don’t

purchase

stocks,

bonds,

ETFs,

or

whatever

else,

your

money

will

just

be

sitting

in

a

glorified

savings

account

not

accruing

substantial

interest.

My

suggestion

for

what

you

should

invest

in?

An

index

fund

that

tracks

the

S&P

500

and

is

managed

with

barely

any

fees.

For

more,

read

my

introductory

articles

on

stocks

and

bonds

to

gain

a

better

understanding

of

your

options.

Or,

you

can

watch

my

deep

dive

into

how

you

can

choose

a

Roth

IRA:

Comments are closed.