Should I Buy a House Now? (5 Guidelines & Perfect Timing Tips)

Not

to

mention,

fluctuating

home

values

can

significantly

impact

your

financial

situation,

especially

if

the

market

trends

lead

to

a

decrease

in

home

values

over

time,

further

compounding

the

financial

burden

on

homeowners.

If

you

move

again

within

a

short

period—for

example,

four

years—all

those

fees

will

dwarf

any

equity

gains

you

may

have.

Imagine driving

a

car

off

the

lot:

We

all

know

that

it

instantly

loses

value.

The

same

is

true

of

your

house,

and

it

takes

time

to

amortize

(or

spread)

the

costs.

Most

people

stay

in

their

house

for less

than

8

years,

and

that

number

is

the

highest

it’s

been

in

several

decades!

Before

the

2008

financial

crisis,

the

average

length

of

time

Americans

stayed

put

was

around

4

years.

Don’t

give

in

to

peer

pressure

to

buy

a

house

if

you

might

not

stay

there

for

the

long

term.

If

you

know

you’ll

move

in

fewer

than

10

years,

you

will

likely

make

more

money

by

renting

and

investing

in S&P

index

funds.

-

Common

mistake: “I’m

not

moving

for

a

few

years.

I

should

buy

so

I

don’t

throw

money

away

on

rent!” -

Reality: If

you

buy

for

a

short

period,

when

you

factor

in

all

costs,

you

will

almost

certainly

lose

money.

Is

your

total

monthly

housing

cost

lower

than

28%

of

your

gross

monthly

income?

Your

total

housing

costs

should

be

less

than

28%

of

your

gross

income,

including

your

monthly

mortgage

payments.

When

housing

costs

exceed

28%,

you

risk

being

overwhelmed

with

expenses

if

something

goes

wrong

(e.g.,

an

unexpected

repair,

job

loss,

etc.) Use

the

28/36

Rule

to

see

if

you

can

afford

your

housing.

Here’s

an

example:

-

Assume

you

make

$10,000/month

(that’s

$120,000

per

year

gross

or

before

taxes). -

Assume

your

total

housing

costs

are

$2,000

per

month,

including

monthly

mortgage

payments.

Great!

Your

housing

costs

you

20%

of

your

gross

income.

You

pass

this

test,

and

you

can

afford

your

housing. -

Note

that

total

housing

costs

include everything:

taxes,

interest,

maintenance,

furniture,

electricity,

water,

and

even

the

roof

repair

7

years

from

now

(project

it).

Evaluating

the

affordability

of

monthly

payments

is

crucial

in

the

context

of

overall

financial

planning

for

a

house

purchase.

It

helps

in

assessing

whether

you

can

maintain

your

lifestyle

without

compromising

on

other

financial

goals.

Why

gross

income?

I

use

gross

because

it’s

easy

to

calculate.

Everyone

knows

their

gross

income,

and

taxes

complicate

net

income

(different

people

choose

different

deductions).

However,

if

you

prefer

to

use

net

income,

go

for

it!

I

love

when

people

create

their

own

points

of

view

on

their

finances.

Exceptions

to

the

28/36

rule

-

If

you

live

in

an

HCOL

(high

cost

of

living)

area

like

NYC

or

Los

Angeles,

many

people

stretch

the

28%

number

to

35%

or

even

40%. -

If

you

have

no

debt

(e.g.,

no

car

payment,

student

loans,

or

credit

card

debt),

you

might

stretch

the

numbers

a

little.

I’d

consider

going

to

around

33%,

but

I’m

conservative

with

my

finances. -

If

your

income

is

reasonably

expected

to

go

up

soon,

such

as

with

a

job

promotion,

you

may

stretch

the

numbers

a

little.

Again,

I’d

conservatively

consider

going

to

33%…

maybe.

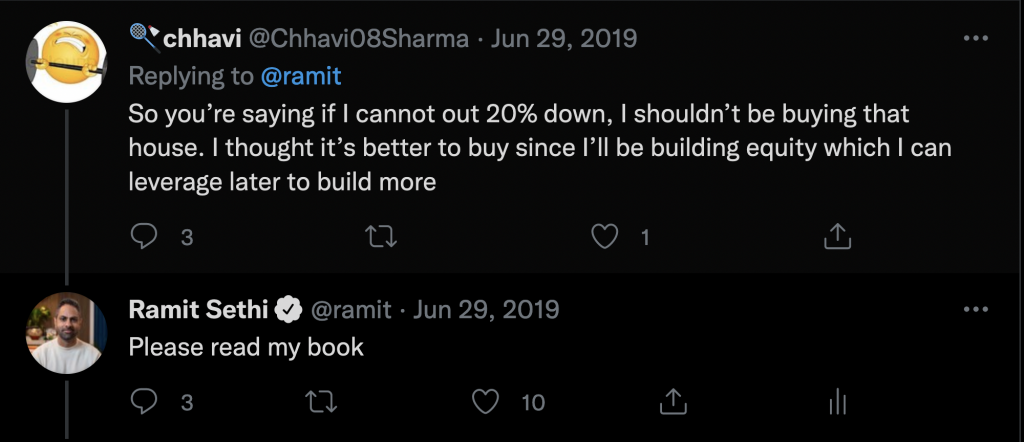

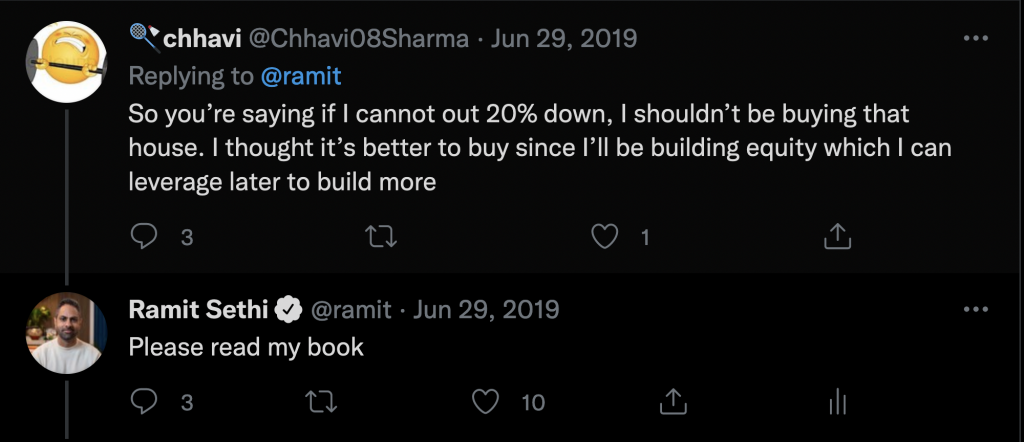

Have

you

saved

a

20%

down

payment?

If

you

haven’t

saved

a

20%

down

payment,

you’re

not

ready

to

buy

a

house.

Why?

Not

just

because

of PMI,

which

is

an

additional

fee

you’ll

often

pay

when

you

get

a

mortgage

without

20%

down.

The

real

reason

to

save

20%

before

buying

is

counterintuitive:

building

the

habit

of

saving

is

critical before you

buy

and

have

unexpected

housing

expenses

such

as

a

broken

water

heater,

roof,

or

unexpected

taxes.

I

frequently

get

frustrated

comments

about

how

“impractical”

this

rule

is.

“How

am

I

supposed

to

save

20%?

That

will

take

years!”

Yes,

it

will—which

is

exactly

why

you

should

save

now.

Saving

is

a

habit

that

is

better

practiced

before

your

mortgage

is

at

risk.

Additionally,

consulting

with

various

mortgage

lenders

to

find

the

best

mortgage

terms

and

rates

can

significantly

impact

your

financial

planning.

The

Federal

Reserve

plays

a

crucial

role

in

influencing

interest

rates,

which

can

affect

how

much

you

need

to

save

for

a

down

payment,

highlighting

the

importance

of

understanding

the

broader

economic

factors

at

play.

If

you

write

a

comment

like

this,

you

are

not

ready

to

buy

a

house.

Note:

I

don’t

mean

that

you

have

to

put

20%

down.

In

some

cases,

such

as

low

interest

rates,

many

people

intentionally

choose

to

put

a

small

amount

down.

But

you

should

be

able

to.

Are

you

OK

if

the

value

of

your

house

goes

down?

If

you

are

buying

because

you

believe

home

prices

always

go

up,

reconsider:

fluctuations

in

home

prices

can

significantly

impact

your

investment,

indicating

that

real

estate

is

not

always

the

best

investment.

Here

are

some

good

reasons

to

buy

a

house

-

You

have

kids,

and

you

want

to

stay

in

your

area

or

school

district

and

build

memories

in

the

same

house

for

at

least

10

years

???????????????? -

Your

parents

are

moving

in

with

you

???? -

You

want

to

design

a

house

together

with

your

spouse

???? -

You

love

repairing

and

tinkering

with

a

house

and

making

it

your

own

???? -

You

just

want

to!

????

Notice

what’s

not

on

the

list:

“You

need

the

price

of

the

house

to

go

up”.

Maybe

it

will—if

so,

great!

Maybe,

once

you

factor

in

expenses

and

opportunity

costs,

you

could

have

gotten

a

much

better

return

in

a

simple

S&P

index

fund.

Buy

for

the

right

reasons!

Are

you

excited

about

buying?

If

you’re

approaching

buying

a

house

with

dread—like

a

heavy

feeling

of

obligation

or

peer

pressure—just

stop.

You

don’t

need

to

buy

and

you

should

never

feel

guilty

about

renting.

I

rent

by

choice.

In

this

video

I

talk

about

why.

Comments are closed.